The price of cryptocurrencies is dropping as interest rates rise. The ones in red include Bitcoin, ETH from Ethereum, and XRP from Ripple. There are several possible causes for the decline of the market.

Status of the Crypto Market

This week also, crypto markets take a deep dive. NEAR and SHIB are the only two big cryptocurrencies (market value > 10 billion dollars) that have gained during the last seven days. The conclusion of Bitcoin 2022 and Solana Miami last week left many in the industry unsatisfied because there was no startling news. Unlike when El Salvador declared that it will adopt bitcoin as legal tender last year.

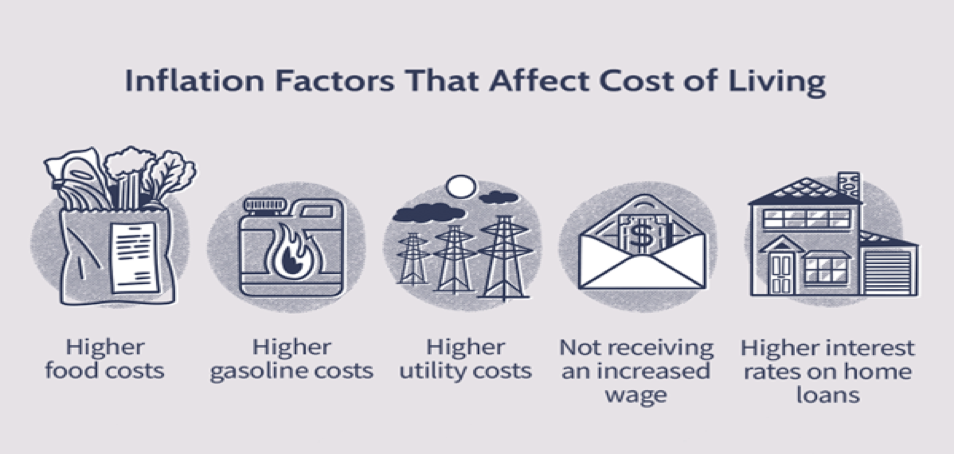

Inflation and pressure on bond prices dominated this week’s headlines. With 1.2% MoM and 8.5% YoY in March, the US inflation rate exceeded expectations by a small margin and reached its highest level in more than 40 years. Owing to this, the FED ultimately abandoned its position that “inflation is temporary,” and the market is now pricing in a rate increase of 50 basis points with a high chance for both May and June. Core inflation, which includes prices for things like food and energy, came in at 0.3% MoM and 6.5% YoY, somewhat below expectations and may have helped to stabilize the market.

Other central banks, like the Bank of Canada and the Reserve Bank of New Zealand just yesterday, are raising interest rates by 50 basis points in response to the FED. The European Central Bank is due to make a rate decision this afternoon, although no change in interest rates is projected.

Risk-on assets are driven lower by any reports of inflation that is stronger than anticipated or by hawkish comments from central bank officials. Higher rates and the value of future cash flows are clearly related in the case of growth stocks. The relationship between rates and prices for cryptocurrencies is not as clear-cut. The 30-day correlation between BTC$ and the NASDAQ reached an all-time high of 0.77, indicating that they behave more and more similar in the recent past.

For cryptocurrencies, the relationship between rates and prices is less obvious. The 30-day correlation between BTC$ and the NASDAQ hit an all-time high of 0.77, showing that their recent behavior has been becoming more and more comparable.

Will Rising Inflation and Rates Continue to Disrupt Stocks?

Ever since the start of 2022, cryptocurrencies, commodities, and stocks have all witnessed major volatility as investors have reported the growth rates and much higher energy costs. With some rate hikes already done and more appearing to be on the horizon, what lies ahead for the remainder of the year?

Even when there is less money moving around in the financial markets, investors have a well-known propensity to look beyond the day’s headlines. Market observers disagree on whether the Fed will act too strongly or too softly and whether this has already been included in stock prices. The markets’ volatility is a direct result of this uncertainty.

In the interim, markets continue to react to these hefty rate increases in the hopes that the Fed would be able to better control inflation and bring it under control. As a result, investors could expect a difficult rest of 2022.

How Must Growing Rates Affect Investment Strategy?

For investors, the combination of soaring inflation, rising rates, and geopolitical war creates a stew of volatility. However, such danger signs may be obscuring solid economic fundamentals, at least in the United States. For instance, customers are prepared to travel and spend some of the money they’ve been saving for the past two years, which is good news for the stocks of travel companies.

According to experts, the labor market is seen as remarkably solid, and economic fundamentals drive returns over the long run.

Strong business profitability, a low unemployment rate, and a sound economy are among the major advantages. The long-term implications of those fundamentals are favorable for stocks, but the short-term effects of rising interest rates will make things more difficult.

Given these solid fundamentals, the ideal strategy for the majority of investors to approach this kind of market is to play the long game. For many, the long-term strategy entails continuing to make regular investments in a diversified portfolio of stocks or bonds while mostly ignoring the commotion in the outside world. Others may decide to buy and keep diverse index funds as part of their strategy. In either case, avoid the feelings that interfere with a successful long-term investing strategy.

While higher rates may give short-term traders the willies, it’s important to maintain perspective. When fundamentals are solid, rates often increase, and equities often do as well.

Yes, markets will recover, and they can even function reasonably effectively during times of rising rates, according to experts. “Numerous studies demonstrate how average stock returns during rising rate periods resemble long-run average returns.” Therefore, buy-and-hold investors can benefit from the market’s volatility and then look for the best time to add more instead of trying to locate the best time to sell.

According to experts, pullbacks create appealing buying opportunities for long-term investors. The opportunity to expand one’s portfolio at a discount during a downturn can be appealing. One pays a very high price in the stock market for a positive consensus, as legendary investor Warren Buffett famously said. In other words, equities are less expensive when fewer people think they’re a good investment.

The Final Lines

In 2022, interest rates have been rapidly increasing, and the current big debate is how high they will rise. Investors with a long investment horizon may believe that the current environment is suitable for purchasing high-quality investments at low costs because the economy is supported by strong fundamentals.