Trading stocks has now become as simple as shopping on the internet. A smartphone allows an investor to accomplish this while sitting in a coffee shop. All it takes is a solid internet connection, a three-in-one account, a mobile banking app, and enough money in the bank account.

Fortunately, all of the time-consuming paperwork may now be completed with a single click or touch on a smartphone screen. The Internet has multiple free and paid mobile and web trading platforms and programs. If done rightly, stock trading could be financially favorable. Investing in the stock market comes with riding the market’s multiple fluctuations. Visit https://cfd-trader.io/ for more information and clarification.

Planning to use a CFD Trading App?

Let’s go through a short tour of what one should know.

About CFD Trading:

CFD trading allows investors to trade a variety of assets, including stocks and cryptocurrencies, and there are several award-winning CFD trading platforms available today. CFD trading applications, on the other hand, are becoming increasingly popular as they allow traders with greater on-the-go control over their assets.

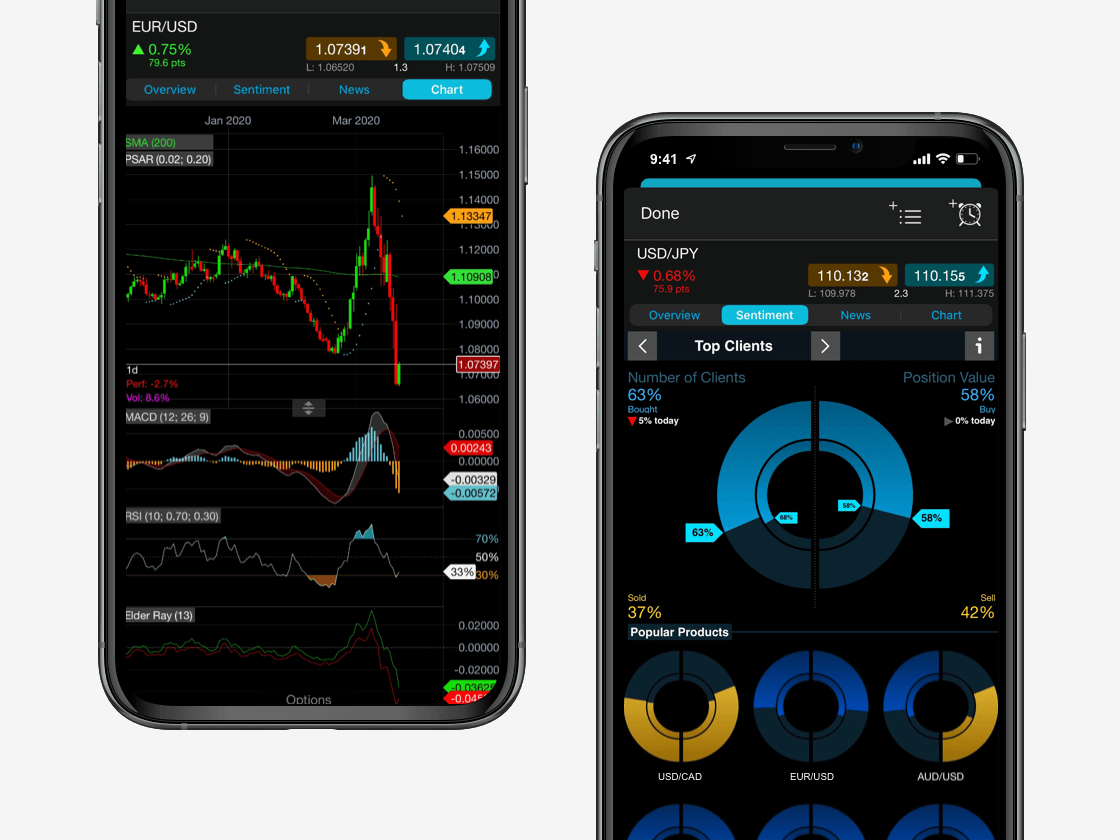

Individuals can conduct trades using a CFD trading app on a mobile device, such as a smartphone or tablet. CFD trading applications are available for download on the iOS and Android app stores, and they provide global access to a variety of markets. Most CFD trading applications have the same interface as desktop platforms, but they also feature mobile-optimized charting and technical analysis capabilities tailored for mobile operating systems.

Advantages of CFDs

Greater Leverage:

CFDs offer a higher degree of leverage as compared to traditional trading. Standard leverages use in the CFD market is controlled. Lower margin requirements mean less capital outlay and higher potential rewards for the trader. Amplified leverage, conversely, might intensify a trader’s losses.

Global Access to Market from One Platform

Many CFD brokers offer goods in all of the world’s major markets, allowing traders to trade at any time of day or night. CFDs could be traded on different global markets by the investors.

No Borrowing Stock or Shorting Rules

Shorting is banned in a few markets, and traders should borrow the instrument before selling it short. Other markets have different margin needs for long and short positions. As the trader does not own the underlying asset, CFD instruments could be shorted at any time with no borrowing charges incurred.

No Fees Professional Execution

Many of the same order types as traditional brokers are available with CFD brokers, including stops, limits, and contingent orders like “one cancels the other” and “if done.” Some brokers who provide guaranteed stops will charge a fee or recover costs in some other way.

Trading Irrespective of Time

Certain marketplaces impose minimum capital requirements or limit the number of day trades that can be executed within a given account. These parameters do not apply to the CFD market, and all account owners can delay trade if needed. Accounts can often be created for as low as $1,000, while minimum deposit requirements of $2,000 and $5,000 are usual.

Wide Range of Trading Opportunities

Stock, treasury, index, currency, commodity, and sector CFDs are now available from brokers. Speculators interested in different financial instruments can now trade CFDs in place of exchanges.

How to begin CFD trading?

Choosing a CFD trading platform is a personal decision based on one’s trading style. Beginners typically look for platforms with a simple user interface and access to hundreds of trading possibilities. To begin trading CFDs, consumers must first log into a CFD broker’s platform software, which can be accessed via a web platform, desktop, or mobile application.

CFD trading via a mobile application has become the favored trading option over the last few years. Because the finest CFD trading applications provide traders with the same services and functionality as web platforms while also offering them more flexibility and freedom.

Advantages of Using the CFD Trading App:

The freedom to trade from anywhere, at any time is a key advantage of utilizing a CFD trading software. To put it another way, traders no longer have to sit in front of their trading screens for long periods. However, there are several other advantages to using CFD trading apps. They are as follows:

Instant Notifications

Traders can set up push, email, or SMS notifications with a trustworthy, award-winning CFD trading app. That means they’ll never miss a trade opportunity, whether it’s for pricing or trading alerts.

Advanced Technology

CFD brokers are continually improving their CFD trading app software so that traders on web-based platforms have access to the same tools and charts.

Offered Everywhere

CFD trading apps are already commonplace, as most firms have begun to prioritize mobile solutions. Traders no longer have to limit their options.

Conclusion:

Lower margin requirements, easier access to worldwide markets, no shorting or day trading rules, and minimal or no costs are all advantages of CFD trading. When huge price moves do not occur, however, excessive leverage multiplies losses and having to pay a spread to enter & exit positions can be costly. So, for any doubts in mind, https://cfd-trader.io/ is there for the rescue. Keep no questions, clarify all worries, and start trading.