In 2025, India’s digital economic system is thriving. Unified Payments Interface (UPI) dominates the mobile bills landscape, clocking billions of monthly transactions. As customer preferences evolve, traders across all scales, from kirana shops to e-commerce systems, want more than awareness; they must embed a UPI QR code generator into their operations to stay competitive. In a proof-based tone, this post highlights how UPI QR code generators are essential for efficiency, data‑powered decision-making, and measurable increases.

UPI’s Ascendancy: A Review Through Data

UPI has seen an exponential increase. As of 2024, month-to-month transaction values surpassed ₹10 lakh crore, with customers topping over half a billion. Adoption is broad-scale, spanning tier‑2 and tier-3 cities. Notably, QR code–based bills include a developing share, outpacing other entry points, including in-app peer‑to‑peer transfers. This confirms one core reality:

- Customers prefer scanning, especially when it’s quick and stable and does not require a merchant account or POS terminals.

Thus, a UPI QR code generator isn’t a fancy add‑on; it’s infrastructure.

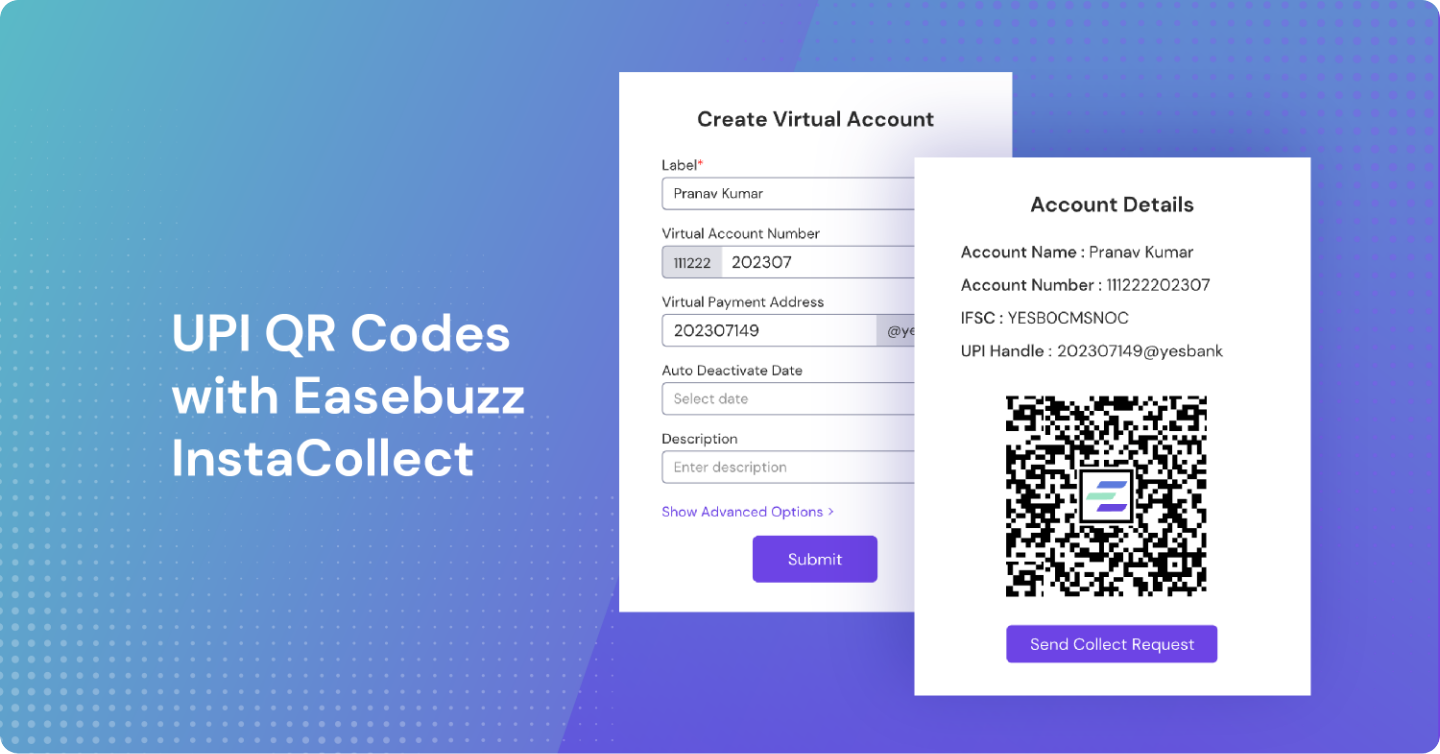

ALT TEXT: UPI PAYMENT QR CODE

Efficiency and Ease: Key Advantages

Rapid, Seamless Transactions

Generating a UPI QR would allow clients to pay instantly. There would be no POS swipe and no price links. The result?

- 0% failed payments, compared to occasional POS/network troubles

- Under 20 seconds per transaction, allowing quicker checkouts

These gains are especially valuable in busy settings, such as street food stalls, groceries, cafes, taxis, and salons.

Lower Setup Costs

Traditional POS machines entail upfront and recurring costs. Comparatively, a digital QR generator, incorporated with present financial institutions or fintech services, is low-fee and eliminates hardware protection. Small traders’ return on investment arrives in only a few days of deployment.

Data-Driven Insights: Beyond Basic Payments

Transaction Patterns

UPI QR code mills log each scan, time, amount, and payer identifier (when the person stocks). These feed into reports revealing:

- Peak hours and days, allowing optimised personnel scheduling.

- The average ticket price value is beneficial for cross-selling and bundling.

- Geographic analytics is used when companies operate across multiple locations.

This actionable intelligence empowers fact-conscious merchants to refine operations, advertising, and marketing campaigns.

Customer Behaviour & Retention

Enable optionally available UPI-based bills with customer identifiers (like cellular numbers or UPI IDs). Over time, styles emerge:

- Frequent clients, for loyalty incentives

- Lapse behaviour, for re-engagement, gives

- Spend bands for personalized upsell promotion.

These segments emerge as worthwhile inputs to loyalty programs and multichannel campaigns.

Compliance, Security & Trust

Regulatory Standards

All UPI transactions agree to NPCI’s layered security:

- Two-factor authentication

- Encrypted communication

- Time-limited, one-time QR tokens

A UPI QR generator, ideally supplied by regulated banks or reputable fintech, ensures built-in compliance, reducing legal responsibility and worry.

Consumer Trust

UPI QR codes are standardised and familiar. When clients scan a Bharat QR or any QR created through a QR code generator app download, they see confirmed merchant names. That reinforces legitimacy and acceptance as accurate, an intangible but essential component in purchase decisions.

Integration & Ecosystem Connectivity

POS and Inventory Systems

Many UPI QR generators plug into POS or cloud-based inventory software. This enables:

- Real-time sales recording, no manual access

- Reconciliation with digital ledgers, decreasing accounting errors

- Automated stock update, helping reorder indicators.

A digitally incorporated sales cycle improves reliability and frees time for fee-based duties.

Marketing Collab

Leverage UPI price facts to tell digital campaigns:

- Geotargeted promotions: run neighborhood ads primarily based on local buying styles

- Offline-to-online linkages: deliver SMS or electronic mail receipts with app-deploy CTAs

- Spend-based offers: upsell high-price clients

Ultimately, offline sales help shape digital advertising and marketing methods.

ALTTEXT : UPI QR CODE

Cost-Savings and Operational Advantages

- No POS mirror prices: Use smartphones or tablets

- Zero downtime: QR scans do not depend on POS hardware

- Minimal training: even a non‑technical staff of workers can use UPI-based bills

- Micro-moment capture: Impulsive purchases are less complicated, while charge friction is eliminated.

These operational efficiencies translate into sharper margins and quicker carriers.

Use Cases Across Indian Business Types

1. Kirana & FMCG Seller

Quick checkout with UPI QR permits daily invoice capture. With spending statistics, providers can negotiate higher deals or pinpoint gaps.

2. Food Trucks & Street Vendors

Compact setup: QR code displayed on a stand, digital ledger updating in historical past, reconciliation by way of day’s cease, easy, rapid, paperless.

3. Service Providers (Salons, Gyms)

QR codes on counters can seize habitual bills, deposits, or increase bookings, logged automatically for follow-up reminders.

4. Multi-Outlet Retailers

Place specific QR codes according to the outlet. Compare overall performance, revisit gradual places, or mirror success through statistics sharing.

5. E-trade with Offline Pickup

Enable COD discount by putting QR codes at pickup points, decreasing coin management, and empowering stock information sync.

Barriers and How They’re Being Addressed

● Connectivity Issues in Remote Areas

Many QR systems now assist offline QR codes, caching data until connectivity resumes. Automated sync guarantees no transaction is lost.

● Tech Literacy

Some traders are hesitant due to the unknown tech. However, UPI’s ubiquity, with more than 450 million energetic users, has normalized scanning across demographics, even in villages and small towns.

● Security Hesitations

Trust concerns with QR misuse or scams are valid. Choosing established UPI QR mills, showing merchant credentials, and adding signage with legitimate UPI trademarks can allay such fears.

Getting Started: A Practical Roadmap

- Select a QR generator from regulated banks or leading fintechs with dashboard access.

- Register identification and link financial institution account: Complete KYC under NPCI norms.

- Generate and display QR codes at counters, product aisles, packaging, or invoices.

- Enable enhanced mode: Include merchant and place identifier metadata.

- Onboard workforce: Show the way to affirm payments and log anomalies.

- Monitor overall performance: Track payment timing, frequencies, and anomalies.

- Run small campaigns: Offer small discounts for UPI-based payments through QR.

- Scale with facts: Use insights to optimize pricing, loyalty programs, and stock.

What to Expect in 2025 and Beyond

QR + Loyalty Ecosystems

Customers test a UPI QR that still adds them to loyalty applications, without extra app installs.

UPI Autopay through Recurring QR

Package services, e.g., memberships, can install scheduled bills through recurring QR ops.

QR-Enabled Smart Schemes

Government and CSR projects utilise QR codes for targeted subsidies and social benefits, with built-in traceability.

Merchant Analytics Marketplaces

Aggregated QR utilisation records (anonymised) will inform network-level insights like shopping power, service calls for hotspots, and local pricing tendencies.

Final Thoughts:

As UPI adoption deepens and digital transaction analysis becomes the cornerstone of commercial enterprise intelligence, a UPI QR code generator isn’t simply useful; it’s crucial for any Indian commercial enterprise in 2025. It bridges physical/digital commerce, integrates with central systems, drives efficiency, and fuels measurable growth through actual international information.

For traders aiming to streamline operations, cut costs, embrace data‑driven techniques, and build trust with tech-savvy Indian consumers, embracing a UPI QR code generator is a strategic imperative. The future of retail and service delivery demands agility, starting with a simple scan.