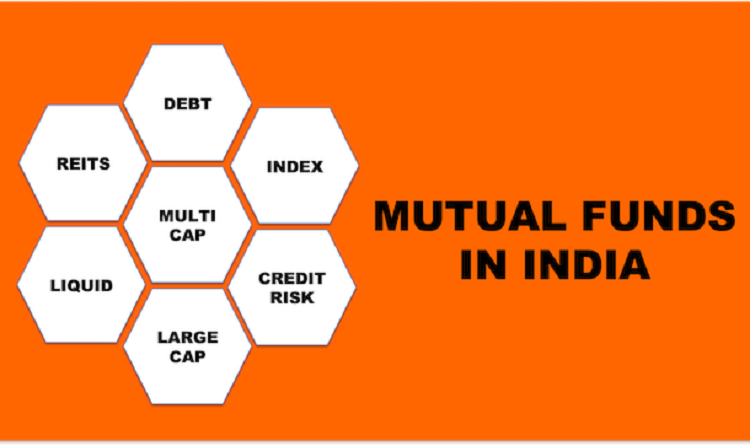

If you are looking for a safe and low-risk investment, then mutual fund is the best option. These are a pool of investment funds, where more than one investor keeps their money. This investment technique will increase your liquid asset and keep it guarded by diversifying the investments. Read this article to know the different types of mutual funds in India that you can invest in.

I. Equity Funds

In equity funds, the money pooled by investors is invested in the stock market. The profit or loss from this type of fund depends on how well the stocks perform. Equity funds aim to generate higher returns which in-turn brings in higher risks and chances of losing your money. The fund manager invests 60% or more in shares of companies and the rest goes into debt funds or other financial instruments. According to the Asset allocation rules, you should preferably invest more in equity funds when you are younger. This is because when you are in your youth, you have the time and energy to earn.

II. Debt Funds

Debt Funds consists of government bonds, Fixed Maturity Plans, liquid funds, short term plans, etc. These funds invest in fixed interest generating financial instruments. A fixed interest rate and a maturity period are given to you when you start investing in debt funds. The fund manager invests in high-rated securities, which have low-volatility, to earn high returns. Debt funds are of short-term consisting of 3 months to 1 year and of medium-term ranging from 3 to 5 years. According to asset allocation, you should start investing in debt funds as you grow older because it gives you secure returns when compared to equity funds.

III. Money Market Funds

Money Market Funds (MMF) invest in liquid instruments with a maturity period of 1-year. This type of funds is best for investors who want quick and intermediate returns. Usually, MMF is schemes that are open-ended and deal in cash or equivalents of it. The types of MMFs are commercial papers, treasury bills, certificate of deposits, etc. Investors who are looking to diversify their investments, as well as a short-term investment, should go for MMF. If you have surplus cash in your bank account and are alright with low-risks, MMF is the best type of mutual fund in India for investors like you.

IV. Hybrid Funds

Hybrid funds which are sometimes called as balanced funds invest both in debt as well as in equity mutual funds for low risks and assured profits. Investing in this type of funds give you better returns than investing in pure equity or debt funds. You are able to get more safety and higher returns by investing in hybrid funds when compared to pure-equity and debt funds, respectively. If you do not want to take any risks, hybrid funds are the safest option. With a balanced fund investment, you are able to gain better returns from your equity investment and build a safety net from the debt funds. This is why hybrid funds are good for conservative investors that do not want to risk it all.

V. Index Funds

Fund managers of index funds invest in the index of a benchmark like Sensex which consists of 30 best-performing stocks. The popular indices of India are the NSE (National Stock Exchange) Nifty and BSE (Bombay Stock Exchange) Sensex. Index funds are passively managed funds because the fund manager doesn’t have to make investment strategies and pick out the best stocks. The role of the fund manager is to match the performance of the funds to that of the index. If you are an investor that doesn’t like to take a lot of risks and wants returns that are predictable, then index funds are suitable for you. But sometimes the returns may not be able to replicate the returns of an index due to tracking error. Tracking error is the difference between the returns you earn from index funds and the benchmark index it was supposed to replicate. Fund managers try to keep the tracking error to a minimum for gaining maximum returns.

VI. Tax-Savings Funds

Tax-savings funds consist of ELSS (Equity Linked Saving Scheme) which allows investors to earn good returns and also save on taxes. This type of investment qualifies for tax deductions, under Section 80C, of INR 1.5 lakhs. Investors are enabled to get tax benefits by investing their income in equity schemes. As ELSS consists of equity, the risk factor is high with increased volatility in short-term investment. If you are open to holding your investments for a longer period of time, ELSS can give you high returns.

Bottom Line

Mutual funds can give you intermediate to high returns depending on your risk appetite. It is best to understand the amount of risk you are comfortable taking before venturing into a high-risk mutual fund. These types of mutual funds give you the opportunity to secure your future with planned investments.