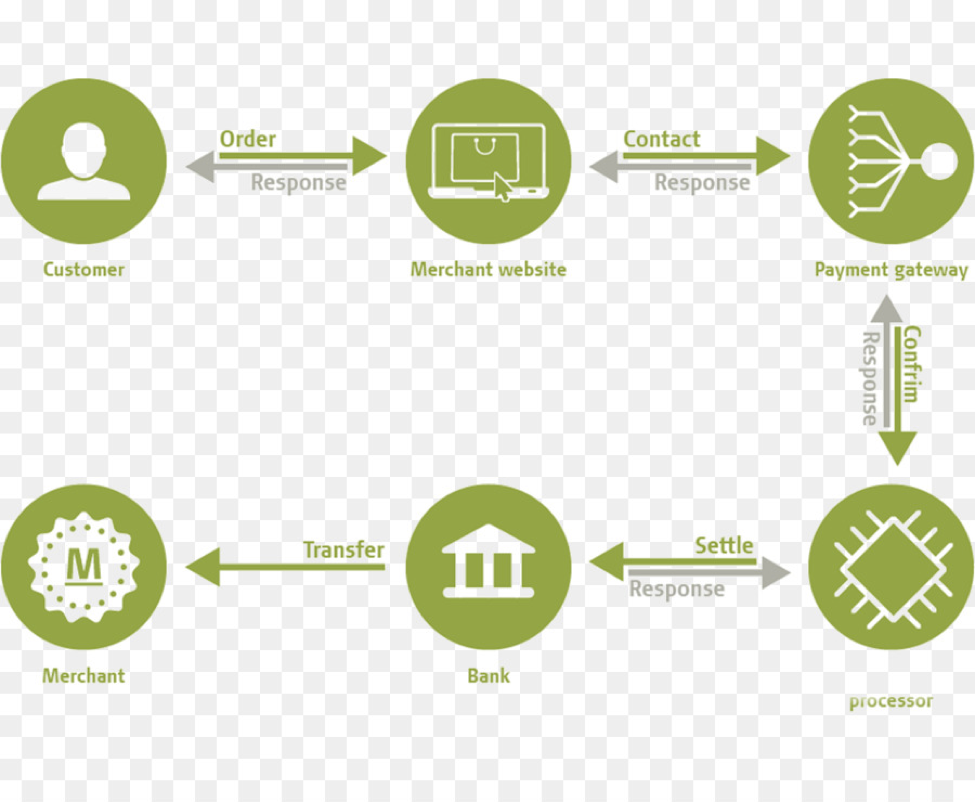

Using payment gateways, businesses can transfer money securely to their customers, and banks can receive transaction data securely. Data from the client is safely delivered from the client to the merchant and the payment system by the payment gateway, which encrypts the data before sending it. Internet usage and online shopping lead to electronic payments. Processes are simple and easy to follow. The risks, however, are significant. By implementing Acuitytec risk management, you can safeguard your business from online fraud and build customer trust.

What Is Payment Gateway?

A payment gateway is a platform that enables merchants to accept payments from customers. It allows merchants to process transactions through the internet, which cuts down on processing time and costs. It also allows merchants to access multiple payment methods, such as credit cards, debit cards, and PayPal. t provides a secure connection between the business and the payment processors so that transactions can be processed quickly and easily. A payment gateway also allows businesses to track the spending of their customers and collect payments automatically. It helps you to process payments, reduce fraud, and keep your customers satisfied.

Different functions, including credit monitoring, customer surveillance, and automatic invoicing, are offered by online payment systems. Additionally, they offer a range of payment processing solutions, such as online payment, e-commerce platforms, and credit or debit card processors. It is a piece of software or a platform that simplifies the holding and processing of one recurring transaction. The purchases may be obtained over the phone or online. This means that a user of this service can enter a transaction of cash and have it either posted immediately to the organization that granted the user’s authority, queued for posting, or posted at a later time.

How does an online payment gateway protect transactions?

The payment gateway will encrypt all data before it is sent to the bank, which means that no one can access your personal information without authorization. Additionally, the payment gateway will track all transactions so that fraudsters cannot make unauthorized purchases. Online payment gateways protect transactions by verifying the identity of the customer and the authenticity of the payment. They also monitor for any fraudulent activity, such as credit card fraud or online fraud. Gateways often offer a variety of security features, such as two-factor authentication, which makes it difficult for someone to log in to your account without having both the physical key and the digital token. An online payment gateway is an essential part of any online business. It helps protect your customers’ data, ensures that all transactions are legitimate, and prevents fraud. This prevents unauthorized individuals from viewing or stealing the information. The gateway also monitors all transactions to ensure that they are completed properly and without fraud.

How can you make your online payment system more reliable?

Authentication and verification determine the legitimacy of the payment. Never approve a purchase request without first making sure it is legitimate. Vendors could overpay for legitimate orders. If you choose to buy from the seller, be sure they have a good reputation and can provide proof that the order is legitimate. As technology advances, hacking happens more frequently. Hackers try to break security and grab crucial customer data from both large and small businesses. Internet businesses must ensure their payment mechanism is secure and protected in order to maintain their customers’ faith. Online payment fraud can be reduced by payment risk management. With an increase in online shopping, accepting payments has become more challenging. By installing a Trusted Payment Gateway system, you can protect your business from monetary loss and cybercrime.