The crypto market continues to be a focal point for traders in India and globally, characterized by its rapid innovation and significant volatility. To capitalize on this volatility while simultaneously managing risk, traders are actively venturing into crypto derivatives, including cryptocurrency options trading.

In this post, we’ll explore some essential crypto trading strategies that you can find on Delta Exchange, and how risk management can help you protect capital.

Basics of Crypto Options Trading

Crypto options are financial instruments that provide traders with a versatile method for speculating on market direction or hedging existing positions. An options contract grants its holder the choice, but not the duty, to buy or sell a cryptocurrency at a predetermined ‘strike’ price on or before a future date. The seller of the option, however, is bound to honor the transaction if the buyer chooses to exercise their right.

These instruments are categorized into two primary types:

- Call Options: A bullish position, giving the holder the right to buy the underlying asset.

- Put Options: A bearish position, giving the holder the right to sell the underlying asset.

With Delta Exchange, you get access to European-style options for major assets like Bitcoin (BTC) and Ethereum (ETH). The availability of a wide spectrum of strike prices and expiry dates allows traders to precisely tailor their strategies to a specific market outlook and risk appetite.

Effective Crypto Options Trading Strategies

Here are some great options trading strategies that you can explore for the crypto market:

1. Swing Trading

Swing trading aims to capture volatility over several days or weeks. To capitalize on fluctuations, a reliable crypto trading app is essential for managing medium-term positions effectively.

2. Range Trading

This strategy is effective when a market is moving sideways between a clear support and resistance level. Range traders aim to buy near the support “floor” and sell near the resistance “ceiling,” profiting from predictable price bounces in low-volatility conditions.

3. Breakout Trading

Breakout trading aims to capture momentum as an asset’s price breaks through key support or resistance levels. It demands a fast crypto platform to trade several cryptocurrencies, including Bitcoin and Ethereum, with minimal slippage, as execution speed is critical.

4. Scalping

This is a high-frequency strategy focused on profiting from small price fluctuations by executing numerous trades held for only moments. Success requires extremely low fees and a platform with deep liquidity.

5. Hedging with Options

Hedging is a critical risk management tactic, not a directional bet. Using crypto options trading, a trader can buy put options to protect their spot holdings from a potential market downturn. For instance, if a trader holds a cryptocurrency and is worried about a price drop, they can buy a put option with a specific ‘strike price’. If the market price of the crypto falls below this strike price, the put option becomes profitable. This profit helps to cancel out the paper loss on their original holdings, effectively insuring their portfolio against a potential market downturn.

This strategy acts as an insurance policy, creating a more resilient portfolio against adverse volatility.

Key Considerations Before Choosing a Trading Strategy

Before deploying capital, it is crucial to align your strategy with your personal trading style and the current market environment. A few practical considerations can make a significant difference:

- Market Condition: Is the market trending upwards, downwards, or moving sideways in a range? The prevailing condition should be the primary factor in your strategy selection.

- Risk Tolerance: Every strategy comes with a unique risk profile. Understand the maximum potential loss and ensure it aligns with your personal risk management rules before entering a trade.

- Trading Costs: Transaction fees can impact net profitability, especially for strategies that involve frequent trading. Take a look at Delta’s Fees Page to understand the cost structure.

- Time Commitment: Some strategies require constant monitoring, while others are less demanding. Choose an approach that fits your lifestyle and schedule.

How to Enhance Strategies with Advanced Trading Tools

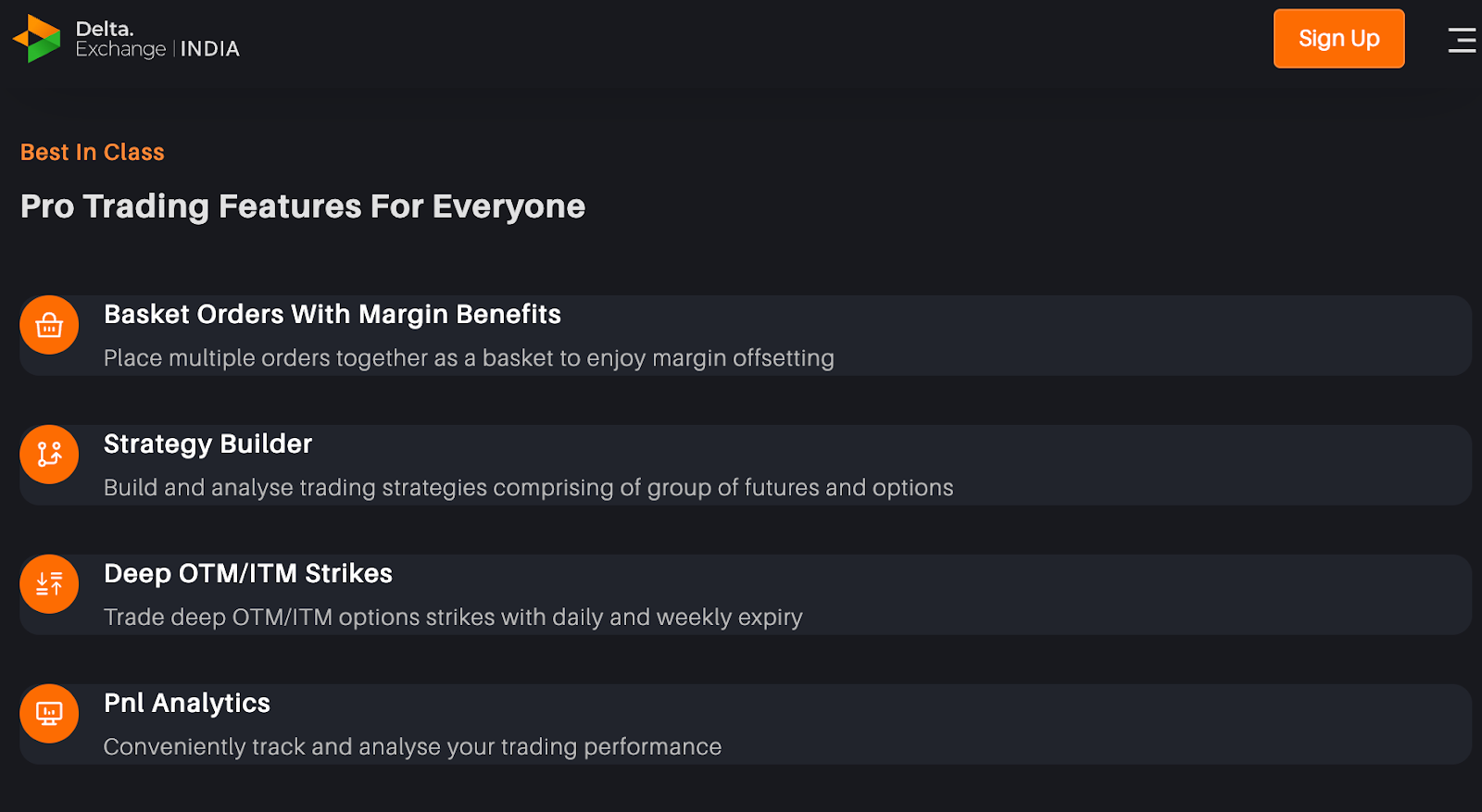

Effective risk management and strategy refinement are key to long-term success. Delta Exchange offers tools to help traders make more informed decisions:

- Practice risk-free on Delta’s demo account to test and refine a strategy before committing real capital.

- Use automated tools by accessing the platform’s Trading Bot or API Page, which can help execute strategies 24/7 without emotional bias.

- Analyze market sentiment and volatility using sophisticated charting tools and analytics features to better time your entries and exits.

The Bottomline

Successful cryptocurrency trading is a blend of the right strategy, disciplined execution, and robust risk management. Crypto trading strategies offer a framework for navigating different market cycles, but their effectiveness is greatly enhanced by the tools available on a premier crypto exchange in India.

With INR-supported transactions, affordable lot sizes, and 24/7 customer support, Delta ensures you have both the tools and the confidence to explore crypto options effectively.

Disclaimer: Investing in cryptocurrency carries a high risk of market volatility. Kindly do your own research before investing.