Do people still do that? It’s not 2017, but nevertheless, Cryptowatch has comb box distribution insub-communities In terms of converse titles. Cryptowatch isn’t a bad place to add to your list, if you frequent Reddit & Co to see what the mood of the community is like. Fairly real and shell free. One good thing to note is that by sharing in converse, you earn credits that you can use for real time price cautions or API data. The cryptowatch desktop is a finest way to increase the profit ratio.

- Technical analysis stock inflow, volume profile, niche TA

- The features of the Cryptowatch web app go far beyond what you can find in a desktop app.

- Not inescapably, Advanced, CryptoWatch is veritably primitive friendly if you stick with the defaults, but there are numerous effects to discover and back test, if that is what you want to do.

- You presumably formerly know that you can trade cryptocurrencies directly- just produce the right kind of API keys on your exchange.

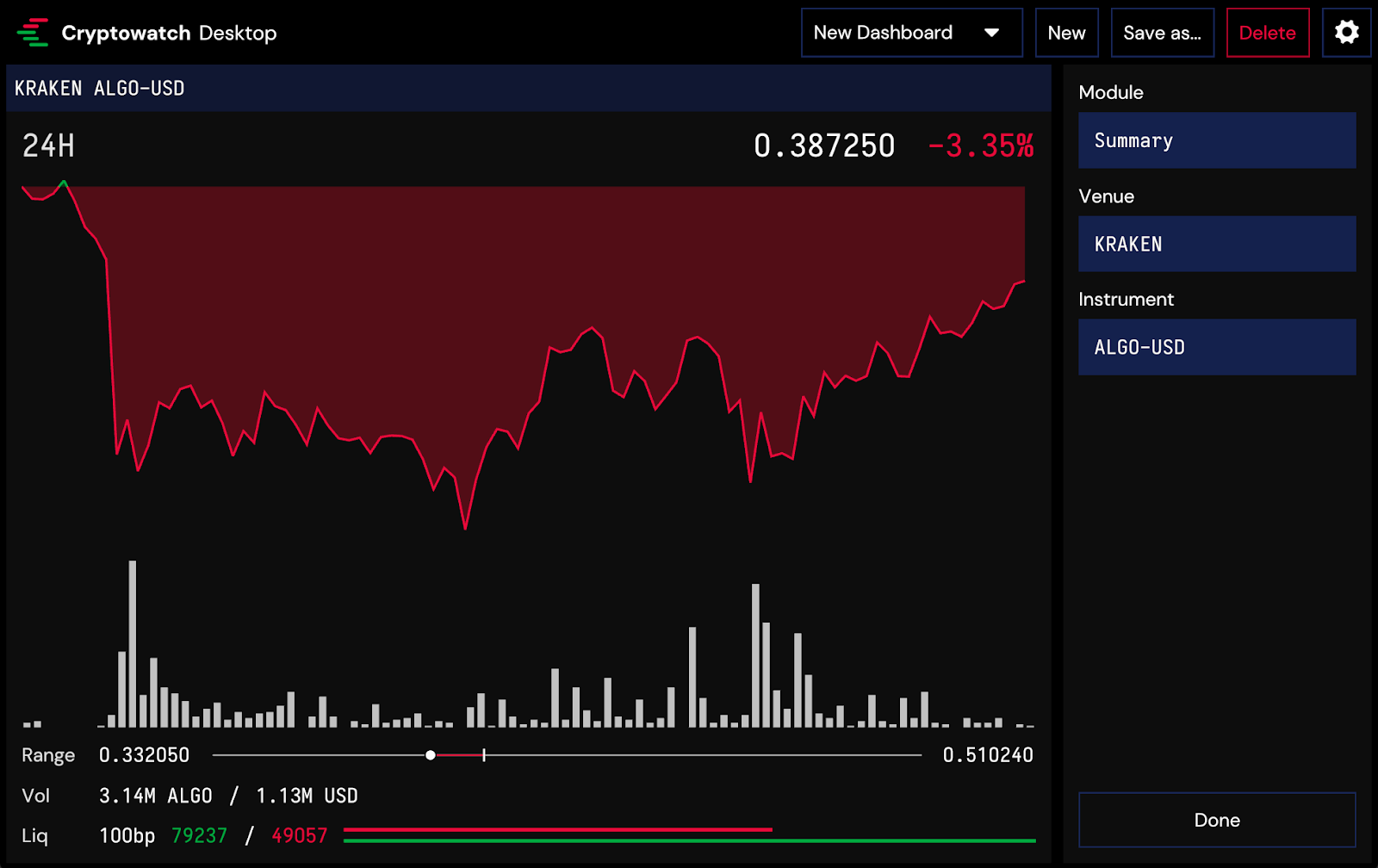

App cryptowatch

As far as specialized analysis is concerned, you will not find a complete public library of programmable pine scripts like you do with TradingView. On a suitable map you get a lot further than just introductory TA tools.

- Volume profile and request profile on crypto watch

- That is the decent thing to do, and it should end there.

- The only catch is that you need to know what to look for.

Volume profile and request profile on crypto watch

- Step 1- Click” Dissect”in the upper right corner of the map and find the volume profile.

- Step 2-You’ll see two options there grouping by trade volume and grouping by time spent on price position.

Both of these options are formerly well- known statistical tools developed for stock trading decades agone.

Time spent at the price position

The time- grounded profile is less nebulous, I am sure. But the principle of this statistical tool is request profile proposition developed by J. Peter Steidlmayer (and trademarked) who wrote a short book that explains veritably well how it works. I would really encourage specialized dealers and judges to read the request profile. Your usual TA tools don’t work over time except to average commodity at certain intervals, so adding a time- grounded tool can make it really easy for you to read that the request in mistrustfulness what’s she doing.

Last but not least, paid tools

CryptoWatch has an API with data that can be veritably delicate to come by, especially when it comes to crypto secondary data. It’s just that they are not available for free. And verity be told, when you want to add other specialized pointers suchlike TradingView, they choose to pay the data rather of bothering you to pay.

Crypto Finance spreadsheet add-on and further

TShe real time price data feed of crypto derivations is commodity you may be missing, If you do cash and carry or other trades that combine futures or options and spots. Piecemeal from homemade input, there are no tools for getting small request price data in a spreadsheet.