How do you make a kill from forex trading quickly? Just like there are many roads a car can take to an airport, there are many suggestions for gaining from forex trading.

However, if you don’t take the utmost care, you may end up blowing up your trading account. Apart from this, bitcoin and other cryptocurrencies are now being accepted by several forex brokers. Trading with the best mt4 ea robot is very profitable, as long as you use the right robot. Thus, one can make investments through several such available platforms; though one will also require doing a background and review analysis (for instance, etoro bitcoin review) of the platforms they chose before investing. Stick by me, as I take you through the undisputed path to having successful forex trading.

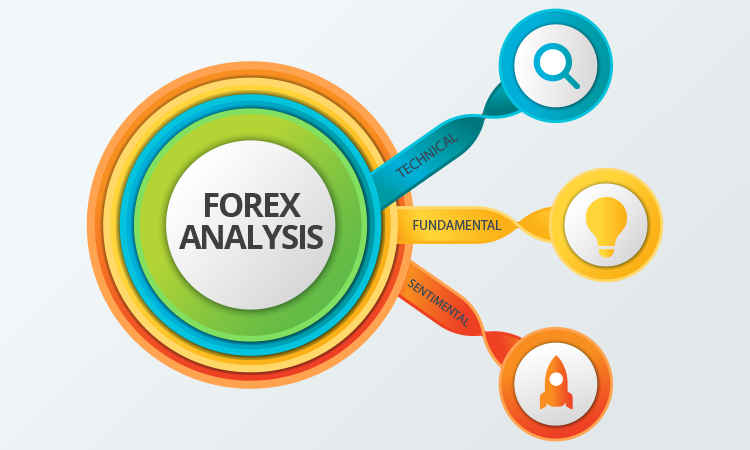

This short guide will help you define and apply analysis in forex trading. Besides, it will recommend digital tools to ease your trade. Let’s dive right in.

What Is Technical Analysis?

Forex trading technical analysis is the forecasting of the future price of a commodity-based on past data. Here’s a simpler breakdown of the analysis:

Forecasting means you apply probability in determining the forex price change. You rely on past behavior of an asset. For example, you want to determine the possibility of earning twice the invested money.

You gather charts for a given duration. In your analysis, you will consider the time and length of the fall. How long did the asset take to bounce to the green mark? What is the average gain when such an asset increases in the price?

This can be a tedious process, right? Yes. However, you don’t have to manually analyze the market. The mt4 platform will ease your technical analysis.

Tracking the charts via mt4 enables you to identify the head-should pattern of the currency. Keep in mind that technical analysis helps you identify when an asset will change in price.

Knowing when a forex’s price changes will guide you in withdrawals and injections. You can monitor when the market hits correction and inject money in your trading account. As soon you project to knock the higher high, you can withdraw your massive gain.

Fundamental Analysis

Here, you focus on the economic, social, or political effects on the price of an asset. Through fundamental analysis, you aim to know why prices change.

Economically, you should focus on the demand and supply of an asset. For example, during a pandemic, most traders would need to convert their currency into a more stable currency like the USD. Consequently, the demand for the USD may rise while that of a less stable currency falls.

Demand results from social and political pressures in an economy. For example, you can predict that price will changes as during international holidays.

Again, prices tend to follow a particular trend when a country’s political pressure increases. The best tool to help you fundamentally analyze price is an Economic Calendar.

Sentimental Analysis

Sentimental Analysis focus on attitude of majority of traders in the market towards risk. Here, you rely on the opinions, moods, or feelings of other traders.

Volatility and market corrections sometimes make it hectic to technically or fundamentally analyze a market.

Consequently, a myriad of traders reverts to reason from personal guts. Interestingly, when a huge percentage of the traders predict the market to project in a direction, the prices drift in that direction.

Besides, influencer traders may cause the market to flow in a direction. For example, if today Warren Buffet states he dollar will fall tomorrow, most traders will sell more dollars.

Hence, demand favors opinions towards the bullish and bearish market movement. For this reason, you should have forex news at your fingertips. You can sentimentally analyze the market via the Webtrader platform.

Key Takeaways

You may be losing in forex trading because you ignore a crucial analysis element of the market. If so, change your mode of analysis to capture the dynamic forex market.

Technically analysis helps you to know when prices will change. Fundamental analysis helps you determine why prices change. Finally, sentimental analysis helps track the opinions of majority traders in the market.

Balancing your trading equation with these analyses is the hot button to press if you want to win from forex trading.