Wealth-tech and fin-tech technologies are changing the future of the banking and investment industry. Many such evolving technologies now predict that in the coming future banks will also feature a social platform that allows customers to search and compare different investment opportunities, which will be AI powered and supported by multiple algorithms. Many commercial banks would be the first to adopt this said change, some might be followers, and many would never be able to get there owing to their poor decision making in current times. Hence, it is strongly suggested by many experienced bankers, that the banking and financial services industry should look to evolve themselves digitally and start incorporating services from wealth-tech and fin-tech startups to prepare themselves better for future dynamics.

Why should banks opt for wealth-tech software?

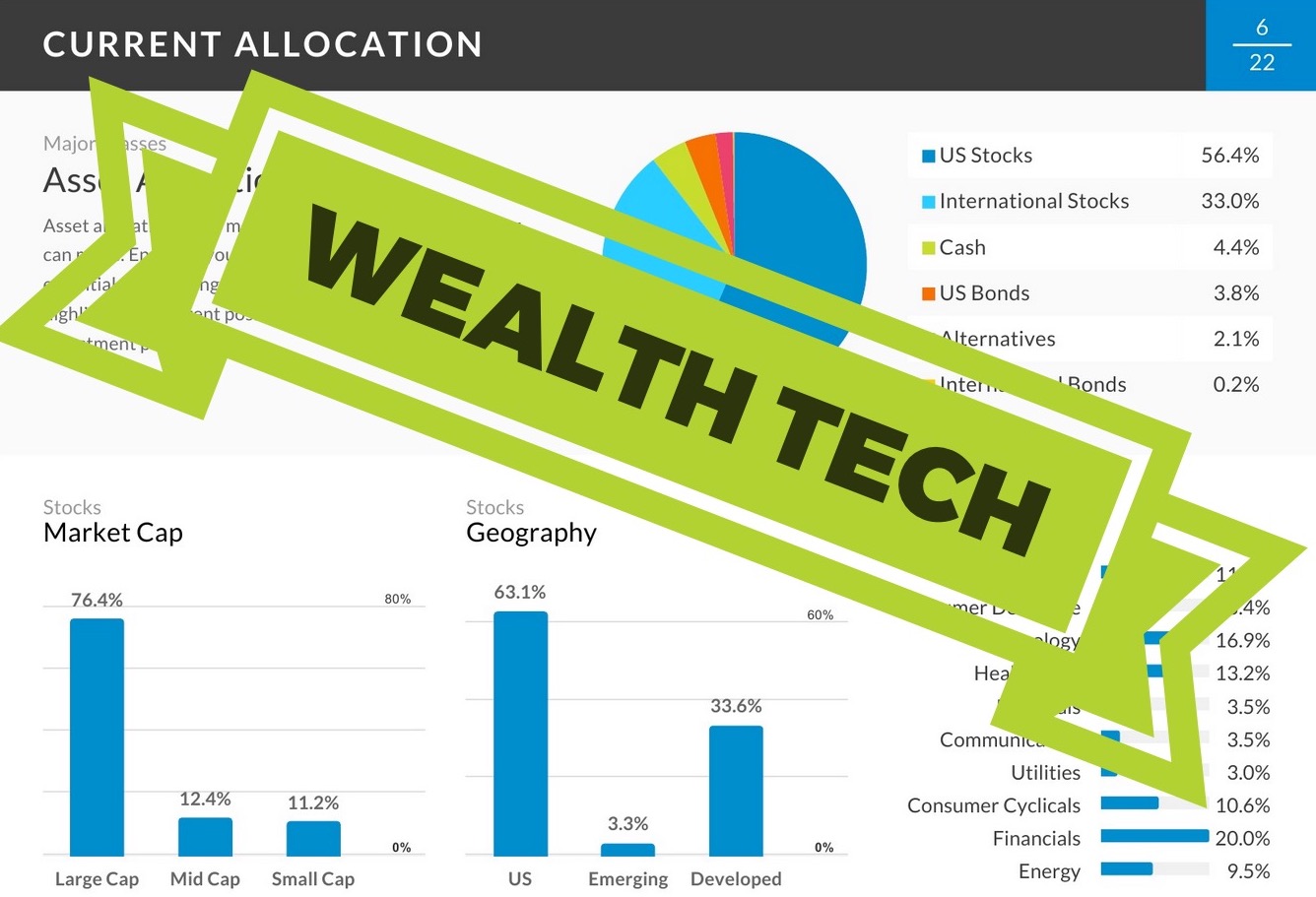

A major benefit of adopting the services of wealth-tech software and companies for banks and other financial institutions is the optimized decision making they facilitate. For instance, the investment portfolio builder – developed by Bambu, a renowned wealth-tech company – allows bankers to make informed decisions to increase profitability for their clients and customers. It essentially allows them to compare and analyze different investment products and portfolios with visual depiction and an interactive interface. It also allows bankers and financial advisors to develop a portfolio in accordance with their client’s risk aversiveness, budget, and expectations.

Another added benefit of banks opting for wealth-tech software for the ultimate profitability of their clients, is staying relevant with changing consumer markets. Customer tastes and preferences are constantly evolving, and adoption of wealth-tech software would allow banks to upgrade their offerings with changing customer demands in a cost effective and sustainable manner.

Additionally, wealth-tech and fin-tech startups are truly revolutionizing the loan risk and credit system upon which banks decide who is deserving to get a loan and who isn’t. This upgrade would give banks and financial institutions a new level of scalability and repute within financial circles.

Furthermore, partnering with wealth-tech companies would allow banks and financial institutions to work on their customer-end surfaces and interface in a much better way. It would allow them to reach their customer base through their smartphones in the most convenient and secure way possible, in addition to revolutionizing their services and offerings.

Wealth-tech companies also come with their set of fortifications against possible data threats, which could be used by banks and investment companies too if they are looking to evolve digitally to increase their consumer base. A fortified and secure base to operate in conjunction with other digital companies would prove great for banks in terms of increasing their customer reach, profitability and relevance.

Whether you are looking to expand your customer base as a commercial or investment bank, or simply looking to evolve in terms of your offerings, partnering with wealth-tech companies like Bambu would be ideal for you. While you’d bring in years of running expertise, Bambu would promise the technical know-how to reach and attract a potentially huge customer databased that you haven’t been ablet to satisfy with your traditional range of services.

Author Bio

Harry Wilson is the Head of Digital Marketing Department at Globex Outreach. He helps clients grow their online businesses and occasionally writes blogs to share his experience with other professionals.